Homeowners Insurance in Belle Glade FL

Finding the right homeowners insurance in Belle Glade can feel like searching for a needle in a haystack. We’ve been there. At Ackerman Insurance Agency, we pride ourselves on being your trusted insurance agency insurance partner. Our local expertise allows us to tailor policies specifically for Belle Glade residents.

Whether it’s protecting your home from hurricanes or exploring the nuances of flood insurance, we’ve got you covered. Our team understands the importance of a solid insurance cover that safeguards your home and personal property. Need an insurance quote? Reach out to us anytime.

And, for those seeking extra protection, our umbrella insurance options offer peace of mind. Let’s make insurance simple together.

Key Takeaways

- Homeowners insurance offers financial protection for your home and belongings.

- Ackerman Insurance provides local expertise and personalized service in Belle Glade.

- Separate flood insurance is crucial in Florida’s hurricane-prone areas.

- Consider umbrella insurance for additional liability coverage beyond your standard policy.

- Request an insurance quote through phone, online, or in-person for tailored advice.

Understanding Homeowners Insurance Basics

Diving into the essentials of homeowners insurance Belle Glade FL, we find it offers a safety net for homeowners, covering both property and liability. While flood insurance isn’t included, it’s critical given Florida’s weather. Ackerman Insurance Agency provides tailored solutions, ensuring you receive an appropriate insurance quote. They provide additional protection options, like umbrella insurance, which extends coverage beyond standard policies. Explore more at SafePoint Insurance.

Coverage Options for Your Home

Exploring the various insurance cover choices for homeowners, you’ll find policies tailored for fire, hurricanes, and theft. In Belle Glade, flood insurance is suggested due to unpredictable weather. Umbrella insurance offers extra protection, especially for those with significant assets. Our agency provides homeowners insurance solutions with personalized service, ensuring you receive a detailed insurance quote that fits your unique needs and circumstances perfectly.

Key Benefits of Homeowners Insurance

Exploring the perks of homeowners insurance in Belle Glade, FL, we recognize its role in safeguarding against unexpected repair costs and legal liabilities. With flood insurance being essential due to Florida’s climate, peace of mind is within reach. Ackerman Insurance Agency ensures personalized solutions. Their expertise helps protect what matters most. Discover more insights by visiting Southern Oak, where they highlight similar value.

Why Choose Ackerman Insurance Agency

Choosing Ackerman Insurance Agency for homeowners insurance Belle Glade FL means tapping into local expertise and personalized service. Our understanding of Belle Glade’s unique risks ensures you get the right coverage. We prioritize customer satisfaction by offering comprehensive options, from standard policies to necessary flood insurance. Plus, our commitment to community involvement demonstrates our dedication. Learn more at Auto-Owners Insurance.

Local Expertise in Belle Glade

With our profound understanding of Belle Glade, we deliver homeowners insurance options that suit your needs. Our local insights ensure you’re protected from Florida’s unpredictable weather, including essential flood insurance. Beyond that, we offer umbrella insurance for extra peace of mind. A personal touch in an insurance agency makes all the difference. At Ackerman, our commitment to Belle Glade shines through in every policy we offer.

How to Get a Home Insurance Quote

Getting a homeowners insurance quote in Belle Glade, FL, requires a straightforward approach. First, gather all necessary details about your property. Reach out to Ackerman Insurance Agency—they’re experts in the area. Discuss your needs, including potential flood or umbrella insurance. Utilize their local insights to tailor the perfect coverage plan. By collaborating with a trusted agency, you’re securing both peace of mind and financial stability.

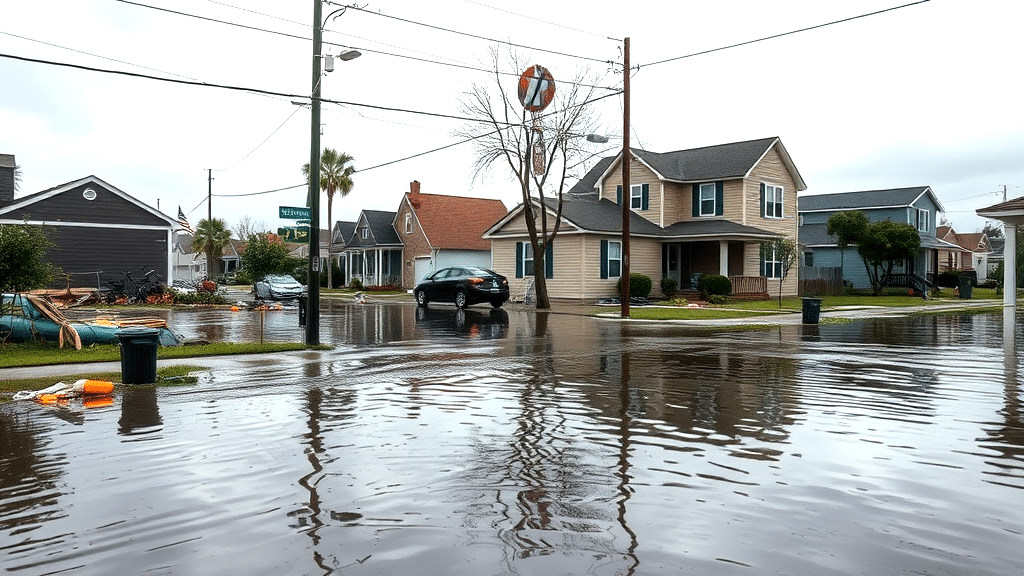

Importance of Flood Insurance in Florida

Understanding the necessity of flood insurance in Florida starts with acknowledging high-risk zones. Our region’s hurricane-prone climate and frequent flooding make it crucial for homeowners in Belle Glade. While standard homeowners insurance covers many events, flooding demands separate attention. Partnering with a reliable agency provides peace of mind. Exploring additional options like umbrella insurance, tailored to your needs, ensures comprehensive protection against unpredictable weather.

What Flood Insurance Covers

Examining the extent of coverage, flood insurance primarily handles damage from rising water levels. Unlike standard homeowners insurance, it addresses specific risks unique to Belle Glade‘s environment. This includes structural damage and loss of personal property due to flooding. However, don’t expect it to cover living expenses during repairs. Understanding this distinction helps us navigate coverage options effectively. Let’s ensure our home suits Florida’s unpredictable weather.

Difference Between Home and Flood Insurance

Exploring the differences between homeowners insurance in Belle Glade, FL and flood insurance is crucial. Home policies cover incidents like fire and theft, safeguarding structures and belongings. Meanwhile, flood insurance addresses damage from rising waters, essential in Florida’s climate. In Belle Glade, understanding these coverage nuances helps us navigate potential risks. By partnering with a knowledgeable agency, we ensure protection tailored to unique local challenges.

Umbrella Insurance: Extra Protection

Beyond basic coverage, umbrella insurance acts as an additional shield for unexpected liabilities. This extra layer comes into play when standard policies hit their limits, offering financial protection. Especially in high-risk areas like Florida, this can be a crucial asset. Our agency in Belle Glade ensures you’re well-prepared, even in a stormy situation. With the right umbrella insurance, peace of mind becomes not just a dream but a reality.

Who Needs Umbrella Insurance

Addressing who can benefit from extra protection, those with significant assets, such as property owners with homeowners insurance in Belle Glade, FL, often find umbrella insurance appealing. This coverage extends beyond standard policy limits, offering peace of mind. It acts like a financial safety net in high-liability situations, safeguarding against unforeseen events. Considering Florida’s unique risks, having this additional layer ensures we’re thoroughly prepared.

How to Determine Coverage Needs

Understanding our coverage requirements begins with evaluating your home’s value and potential risks. In Belle Glade’s unique climate, flood insurance becomes indispensable. Meanwhile, umbrella insurance offers additional protection beyond standard limits. By collaborating with a reputable agency, we ensure financial security tailored to local needs. This proactive approach keeps us prepared for any storm life throws our way.

Factors Influencing Insurance Rates

Navigating what affects our insurance costs can feel like untangling Christmas lights. In Belle Glade, Florida, home characteristics like age and construction materials play a leading role. Proximity to natural hazards like floods or hurricanes elevates risk—and rates. Our choice of deductibles impacts premiums too. Partnering with a reliable insurance agency helps us balance coverage and costs effectively, ensuring peace of mind.

Tips to Lower Home Insurance Premiums

To reduce what we pay for insurance, focus on home upgrades. Enhancing security features like alarm systems or fortified windows can lead to lower premiums. Let’s not overlook bundling policies with one agency insurance agency. This often results in discounts. Increasing deductibles is another option, though it requires a safety net. Lastly, umbrella insurance can provide broad coverage, ensuring comprehensive protection without breaking the bank.

Mandatory Insurance Requirements in Florida

In Florida, understanding the insurance mandates for homeowners is key. Although not legally required, mortgage lenders often demand it. For those seeking homeowners insurance in Belle Glade, FL, examining comprehensive coverage options is essential. Local agencies provide tailored solutions to fit unique needs. By visiting Southern Oak, homeowners can explore diverse policies that align with specific requirements and ensure adequate protection against potential risks.

Personalized Insurance Solutions

Customizing our insurance options means we address the unique needs of each client. For those with homeowners insurance in Belle Glade, FL, considering additional coverage like umbrella insurance can be beneficial. This extra layer provides invaluable protection against unexpected liabilities, especially in a state prone to natural risks. A thoughtful approach ensures our policies are as diverse as our clients’ needs, safeguarding against potential mishaps.

Comparing Insurance Agencies in Belle Glade

Evaluating different agencies in Belle Glade can feel like navigating a maze. But let’s cut to the chase: we all want the best deal on homeowners insurance in Belle Glade, FL. This means considering local expertise and customer service. We should prioritize agencies that understand our needs and offer transparent policies, ensuring peace of mind without emptying our pockets.

How Ackerman Ensures Customer Satisfaction

Our commitment to satisfaction is unwavering. We craft policies that suit your needs, especially for those seeking homeowners insurance in Belle Glade, FL. Our team remains responsive, always ready to address concerns or questions. With a proactive approach, we anticipate potential challenges and adjust policies accordingly. Our goal is to provide peace of mind, allowing you to focus on what truly matters—your home and family.

The Claims Process Simplified

Simplifying the claims journey is like a breath of fresh air. We’ve all faced the dreaded paperwork mountain, right? In Belle Glade, FL, we transform this maze into a walk in the park. Contacting us, you’ll find a touch of humor and a sprinkle of empathy. We ensure that every step is transparent, making the experience as easy as pie.

Steps to File a Claim

In filing a claim, start by promptly contacting your provider. Have your policy number ready and clearly describe the damage. Document everything with photos or videos. An adjuster will assess and estimate repair costs. Patience is key during this step. Meanwhile, the Citizens Property Insurance Corporation offers online resources to guide you through the process. Visit their website for more insights.

Common Home Insurance Claims

Navigating the labyrinth of typical claims with homeowners insurance in Belle Glade, FL can be daunting. Water damage often tops the list, from leaky roofs to burst pipes. Fire incidents follow closely, given Florida’s climate. Theft and vandalism are also frequent culprits. Meanwhile, wind damage, especially during hurricane season, keeps adjusters busy. A local map highlights Belle Glade’s unique challenges: see here.

Understanding Insurance Policy Terms

Deciphering the terms of your policy helps us make informed decisions about our coverage. Different clauses can impact how claims are processed, especially for those in Belle Glade, FL. Recognizing exclusions or limitations ensures we avoid surprises during claims. The type of coverage influences our financial safety net. For Florida-specific insights, look at resources like Security First Florida’s website for detailed information.

How to Review Your Insurance Policy

When it comes to examining our coverage, focus on policy limitations and exclusions. For those navigating homeowners insurance in Belle Glade, FL, it’s like reading the fine print on a treasure map. Scrutinizing these details helps us avoid unexpected surprises during claims. Let’s ensure that our financial safety net is as robust as it can be, preparing us for any eventualities.

Saving Money on Homeowners Insurance

Reducing costs on home coverage in Belle Glade, FL involves a bit of strategy. We can bundle policies or increase deductibles to lower premiums. Safety upgrades, like security systems, offer discounts too. Staying informed about the area’s risks, such as hurricanes, is crucial. Companies like Southern Oak emphasize tailored solutions, ensuring peace of mind while keeping finances in check.

Discounts Available at Ackerman Agency

At Ackerman Agency, we offer various ways to save on your coverage. By bundling policies or installing safety features, you can access meaningful reductions. Our clients in Belle Glade, FL appreciate the personalized touch, ensuring their insurance aligns with both their needs and budget. Get in touch with us to explore how these opportunities might apply to you. Interested in learning more? Reach out today!

Customer Testimonials and Reviews

Hearing from those who’ve embraced homeowners insurance in Belle Glade, FL? It’s enlightening! One customer joyfully shared how Ackerman’s team swiftly handled their claim after a hurricane. Another praised the agency’s proactive communication, ensuring clarity. When a neighbor experienced an unfortunate fire, they highlighted the invaluable support provided. These voices underline the importance of having a reliable partner in safeguarding our homes and peace of mind.

Community Engagement and Support

Ackerman’s active participation with Belle Glade locals strengthens connections and trust. We support initiatives that boost community spirit, benefiting our clients as well. Involving ourselves in local events allows us to understand residents’ specific concerns, making our service more relatable. Our commitment isn’t just about providing policies; it’s about being there for neighbors, sharing experiences over a cup of coffee. This enhances our approach to homeowners insurance Belle Glade FL.

Contact Ackerman Insurance for More Information

When reaching out to Ackerman about your homeowners insurance in Belle Glade, FL, we make it easy. Whether you prefer phone calls, online inquiries, or face-to-face visits, we’re here. Our team is ready to guide you through policy options and answer any questions. No need to worry—our expertise ensures you’re well-informed and confident in your insurance choices. Let’s chat.

Conclusion

At Ackerman Insurance Agency, we prioritize your peace of mind. We know that choosing the right homeowners insurance can seem like navigating a maze. But rest assured, we are your trusted guides through the twists and turns. Our focus remains on providing personalized solutions tailored to your unique needs.

We understand the heartbeat of Belle Glade and are committed to supporting our community. Our reputation is built on genuine relationships, ensuring our clients feel heard and valued. With us, you’re not just another policy number; you’re part of our family. So, whether you’re looking for a quote or simply need advice, reach out. Let’s safeguard your home and future, together.

FAQ

- What are the basic components of homeowners insurance?

Homeowners insurance acts as a safety net. It includes protection for your home’s physical structure, personal property, and offers liability protection. It also covers additional living expenses if you need to relocate temporarily. Though not legally mandatory in Florida, mortgage lenders often require it.

- What coverage options should I consider for my home?

Standard policies usually cover fires, hurricanes, and break-ins. However, they don’t include flood insurance. Given Florida’s climate, a separate flood policy is crucial. Consider umbrella insurance for added liability if you have substantial assets.

- Why is Ackerman Insurance Agency a good choice for homeowners in Belle Glade?

Ackerman Insurance boasts local expertise and personalized service. Our deep understanding of Belle Glade helps us offer tailored solutions. We prioritize customer satisfaction and provide comprehensive coverage options. Our clients’ stories and feedback speak volumes.

- How do I get a home insurance quote from Ackerman Insurance?

You can reach out to us via phone, online, or in person. We provide detailed quotes to help you understand your options. Our team is ready to assist with personalized advice and support.

- Why is flood insurance important in Florida?

Given Florida’s hurricane-prone nature, flood insurance is essential. Standard homeowners insurance won’t cover flood damages. Protecting your home from flooding is wise, especially in high-risk zones.