Top Homeowners Insurance in Wellington FL – Ackerman Insurance Agency

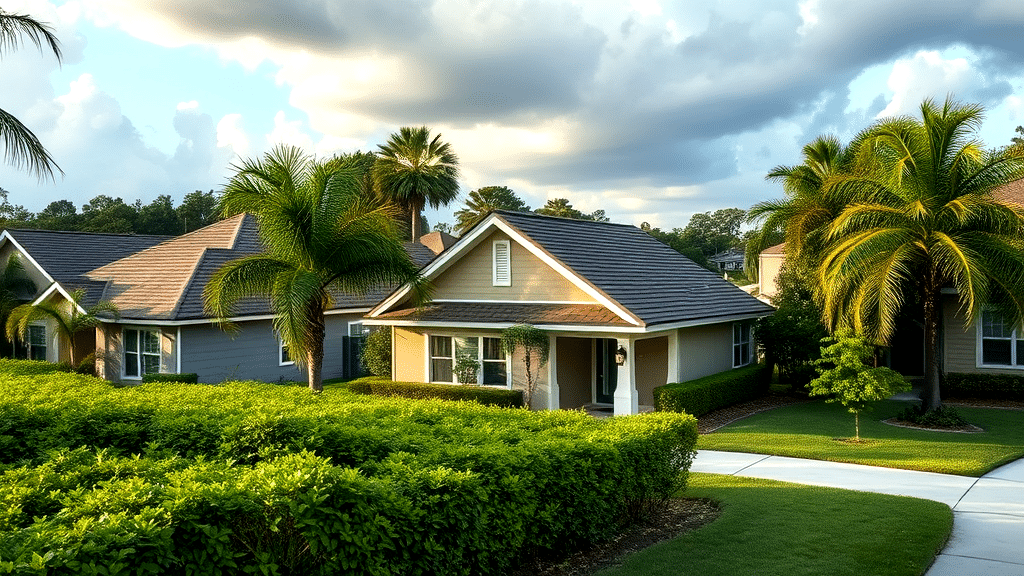

Finding the right homeowners insurance in Wellington, FL, can feel like searching for a needle in a haystack. Local expertise makes a world of difference, especially when hurricanes and flooding are recurring nightmares in Florida. Ackerman Insurance Agency shines with its personalized service and deep community ties. They know what makes Wellington tick and can tailor policies to meet unique local needs. Why settle for a generic policy when Ackerman offers a custom fit? From homeowners insurance to separate flood insurance, they’ve got it all covered. Plus, obtaining an insurance quote is a breeze. For those on the hunt for top-notch homeowners insurance companies, Ackerman is a local favorite.

Key Takeaways

- Local agencies offer personalized service and understand regional risks like hurricanes.

- Florida homeowners insurance is often required by lenders, though not by law.

- Key coverage includes protection against fires and hurricanes; flood insurance is separate.

- Ackerman Insurance Agency is a local favorite for comprehensive and tailored policies.

- Obtaining a customized insurance quote from Ackerman is straightforward and user-friendly.

Why Choose Local Insurance Agencies

Opting for a neighborhood insurance agency can be like discovering a hidden gem. They know Wellington, FL, inside out, offering the best homeowners insurance Wellington FL. These agencies engage with the community, understanding local needs and risks like hurricanes. Their personalized approach offers more than generic policies.

Why settle for impersonal service when our local experts provide tailored solutions? They navigate Florida homeowners insurance challenges, offering insights into floods and other perils. Our agents communicate effectively, ensuring you understand every detail of your home insurance policy. Opt for a local agency—where service isn’t just a promise; it’s a way of life.

Understanding Homeowners Insurance in Florida

Deciphering the nuances of homeowners insurance in Florida can be as tricky as a cat on a hot tin roof. Policies often cover the home’s structure, personal belongings, and liability, but flood damage is usually left out. That’s where separate flood insurance steps in. With the best homeowners insurance Wellington FL, you get peace of mind in a hurricane-prone locale. It’s all about choosing a local insurance agency that understands Florida’s unique risks. Their expertise can guide you through obtaining comprehensive coverage. Local knowledge means they know the ropes, ensuring you’re not left high and dry when it matters most.

Key Coverage Areas for Homeowners Insurance

Exploring the essential areas covered by homeowners insurance is like peeling an onion—layers of protection for various risks. In Florida, policies generally shield against hurricanes, fires, and theft. But here’s the twist: flood damage often requires separate coverage. This makes flood insurance indispensable. It’s like a seatbelt on a roller coaster, providing extra safety in storm-prone areas. Our insurance agency ensures you grasp these facets, offering insights tailored to Wellington’s unique climate. By understanding these specifics, we empower you to make informed decisions. In the end, choosing the right homeowners insurance companies means no surprises, just peace of mind.

Is Homeowners Insurance Mandatory in Florida?

Is homeowners insurance a legal requirement for Floridians? This question often crops up among our fellow residents. Although not mandated by state law, many mortgage lenders insist on it. This ensures their investment is protected, especially with Florida’s unpredictable weather. For those in Wellington, finding the best homeowners insurance is crucial. It’s not just about meeting lender demands; it’s about safeguarding your home from potential calamities. We know the local climate poses unique challenges. Therefore, selecting a reliable insurance agency becomes imperative. This is why choosing a local expert, seasoned by Wellington’s nuances, can provide a tailored approach to your home insurance needs.

Factors Influencing Homeowners Insurance Rates

When considering the variables impacting homeowners insurance premiums, location plays a pivotal role. Homes in Wellington, FL, face unique challenges like hurricanes, affecting rates. The home’s age and construction type also contribute. Older homes or those with outdated materials might see higher premiums. A homeowner’s claims history is another determining factor. Frequent claims can lead to increased costs. Seeking the best homeowners insurance Wellington FL can seem like a wild goose chase. But remember, selecting a reputable insurance agency ensures you’re well-advised. For further insights, check out AM Best’s rating news. They offer valuable information on industry trends.

Top Homeowners Insurance Companies in Wellington

Acknowledging the top homeowners insurance companies in Wellington, insurance enthusiasts will find plenty of choices. State Farm, Progressive, and Security First lead the pack with comprehensive offerings. State Farm’s charm lies in its dedicated customer service and local agent presence. Progressive shines with customizable policies, catering to diverse needs. Meanwhile, Security First provides robust protection against Florida’s weather quirks.

Let’s not forget Ackerman Insurance Agency, a local favorite, known for its personalized and detailed service. They ensure your home insurance aligns perfectly with unique Florida homeowners needs. Their expertise is invaluable for navigating the intricacies of obtaining an insurance quote, making them a top choice.

Ackerman Insurance Agency: A Local Favorite

The folks at Ackerman Insurance Agency, beloved by locals, know Wellington’s intricacies like the back of their hand. Their expertise in Florida homeowners insurance is unmatched, making them a go-to for securing the best policy. With a knack for understanding regional challenges, such as hurricanes, they offer rock-solid home insurance options. Need a custom insurance quote? They’re ready to assist. As a trusted insurance agency insurance, their commitment to clients is evident in their tailored solutions. Flood-prone areas require special care, and they ensure your coverage includes essential flood insurance. In a state where every detail matters, Ackerman stands out.

Customer Reviews and Testimonials

Feedback from our clients underpins our reputation as the best homeowners insurance provider in Wellington, FL. Many appreciate our responsiveness, telling stories of how we’ve turned potential headaches into mere bumps in the road. “They saved us when a hurricane loomed,” one client recalls, lauding our swift action and understanding. Our knack for finding optimal coverage solutions is a common theme. We pride ourselves on crafting policies that fit like a glove.

People often highlight our knowledgeable team, whom they trust to navigate the complexities of Florida’s insurance market. It’s these stories that fuel our passion and drive to remain a top choice.

How to Get a Homeowners Insurance Quote

To explore the best homeowners insurance in Wellington, FL, connect with the local Ackerman Insurance Agency. They specialize in personalized service, understanding the unique needs of Florida residents. Start by giving them a call or visiting their website. Here, you’ll provide basic details about your property, which sets the stage for tailored recommendations. Curious about bundling options with flood insurance? Ask about it! Their knowledgeable agents ensure you receive a complete quote, addressing both expected and unexpected risks. Remember, a thorough review of various plans can help you make an informed decision. Getting the right coverage is crucial in safeguarding your home.

Flood Insurance: A Necessary Add-On?

Is flood insurance truly an essential add-on in Wellington, FL? Given the region’s susceptibility to floods, it’s a safety net we can’t overlook. Our standard home insurance might patch over various perils, but flood coverage fills the significant gap in our defenses. It’s like a reliable umbrella in a storm, ensuring our peace of mind. Securing both types of coverage, especially through a local agency, can be our best bet. For those still pondering, Citizens Property Insurance Corporation provides valuable insights into the necessity of flood insurance in Florida here. It’s all about making sure our homes are shielded against whatever Mother Nature throws our way.

Comparing Home Insurance Discounts

When reviewing home insurance discounts, a strategic approach can lead to substantial savings. In Wellington, FL, securing the best homeowners insurance entails exploring policies offering reductions for bundling, security upgrades, and maintaining a favorable credit score. Our local agency excels in identifying valuable opportunities, ensuring clients maximize their benefits.

Many discounts derive from bundling home and flood insurance, a crucial consideration given Florida’s climate. Additionally, installing safety devices can lower premiums significantly. We often find that a proactive strategy, like regular reviews of your policy, helps keep costs in check. By meticulously analyzing options, we ensure our clients secure comprehensive protection without breaking the bank.

Tips to Lower Your Premiums

Lowering premiums can be akin to finding a hidden treasure in our quest for the best homeowners insurance Wellington FL has to offer. Increasing your deductible might seem daunting, but it can significantly reduce what we pay monthly. Enhancing our home security is another clever move; insurers love a well-guarded fortress. Bundling policies together? That’s like biting two cherries with one bite! Lastly, let’s not forget to regularly review our policies. Much like checking the weather before a day out, this ensures we’re getting the best deal. For insights into regional disaster preparations, the Florida Office of Insurance Regulation provides tools here.

Importance of Comprehensive Home Insurance

Understanding why extensive home coverage is essential can be like navigating a maze. Our homes are our castles, but disasters don’t ask for invitations. Having the best homeowners insurance Wellington FL offers isn’t just about peace of mind; it’s our financial shield. Local agencies, with their regional expertise, offer tailored solutions. Flood insurance, often overlooked, becomes crucial in a state like ours. It’s like wearing a raincoat in a drizzle; it’s necessary even when we hope it’s not. Our goal? To ensure our dwellings are fortified against life’s unpredictable storms. Trusting a local agency means navigating this maze with confidence.

Protecting Your Home Against Natural Disasters

Choosing the right coverage is essential for securing our homes from nature’s whims. Our local experts provide insights into selecting the best homeowners insurance Wellington FL offers, emphasizing regional risks. In a state prone to hurricanes, understanding coverage nuances is crucial. Flood insurance, often overlooked, is mandatory for comprehensive protection. Our agency’s expertise ensures tailored solutions, considering factors like home age and location. By prioritizing local knowledge, we align policies with specific needs. Regular policy reviews become as natural as Florida sunshine, ensuring optimal protection. Prioritizing these elements helps safeguard our properties, even when the weather doesn’t play nice.

Understanding Insurance Policy Terms

Deciphering the terms of a home insurance policy can seem like untangling a ball of yarn. Policies often include clauses about deductibles, exclusions, and liability limits, which can impact our coverage significantly. We’ve found that understanding these elements is crucial when seeking the best homeowners insurance Wellington FL offers. Imagine a scenario where a policy excludes certain natural disasters, leaving us vulnerable. Isn’t it like discovering the last piece of a puzzle isn’t a fit? Navigating these terms ensures we’re not just covered but truly protected. Our aim is to ensure our homes remain safe havens against life’s unexpected twists and turns.

Common Home Insurance Myths

Misconceptions about home insurance can lead to costly oversights. One common misunderstanding involves the notion that home insurance covers all types of water damage. In reality, many policies exclude flood-related incidents, making separate flood insurance a wise choice. Some believe newer homes automatically have lower premiums due to modern construction. However, factors such as location and claims history might alter this assumption. For a comprehensive overview of policy options, including advice on securing the best homeowners insurance Wellington FL offers, consider exploring online reviews. They offer firsthand insights into what different agencies provide, such as those shared here.

How to File a Home Insurance Claim

Venturing into the realm of filing an insurance claim involves several crucial steps. First, assess the damage and document everything meticulously—photos and videos are invaluable. Communicate promptly with your insurer, providing a detailed account of the incident. It’s like painting a vivid picture; every detail matters. Next, complete the necessary claim forms, ensuring no stone is left unturned. Engaging a local insurance agency can be our guiding light, especially in a place like Wellington, FL. Their familiarity with local claims processes can streamline this journey. Patience is key. It ensures we secure the best possible outcome, safeguarding our precious assets.

Frequently Overlooked Home Insurance Coverage

Exploring coverage options often reveals gaps that leave us exposed. One critical aspect is personal property coverage for high-value items. These aren’t always fully protected under standard terms, requiring additional policies. Another overlooked area involves ordinance or law coverage, essential for complying with updated building codes after damage. It’s like discovering hidden gems in a treasure chest; these options ensure comprehensive protection. Engaging with a local agency is wise, as they tailor policies to individual needs. After all, selecting the best homeowners insurance Wellington FL offers means considering these nuances and avoiding potential pitfalls hidden within generic policies.

Importance of Regular Policy Reviews

Regularly revisiting our policies is like tuning a musical instrument; it ensures everything harmonizes. We might think we’ve nailed the best homeowners insurance Wellington FL has, but life has a way of changing the tune. Have you ever found yourself humming an old song, realizing it no longer resonates? That’s what skipping policy reviews feels like! Adjustments can reveal hidden gaps and opportunities for savings. Who doesn’t love a good deal, right? Our priorities shift, sometimes as fast as Florida’s weather. By staying proactive, we ensure our coverage aligns with our current needs, providing peace of mind and financial security.

How to Choose the Right Deductible

Choosing the right deductible is a balancing act between risk and savings. Higher deductibles typically lower premiums, but they also mean more out-of-pocket costs when filing a claim. If we’re prone to frequent smaller claims, a lower deductible might make sense. However, if we’re confident in our home’s condition and willing to handle minor issues ourselves, a higher deductible could save us money in the long run. It’s like betting on a horse race—calculated risks can lead to significant rewards. For those seeking the best homeowners insurance Wellington FL offers, considering local factors and potential risks is crucial.

Comparing Bundled Insurance Options

Navigating the array of bundled insurance packages can feel like finding the perfect puzzle piece. Each option offers unique perks and potential savings. Combining policies, like auto and home, might unveil hidden discounts. For those eyeing the best homeowners insurance Wellington FL can offer, bundling can be a smart move. We often notice that bundling provides not just financial benefits, but also the ease of managing fewer policies. It’s like having one key for several locks—simple and efficient. Exploring these options with a trusted local agency ensures we snag the best deal, tailored to our specific needs.

Contacting Ackerman Insurance for More Information

When reaching out to Ackerman Insurance for insights, we find they offer personalized service tailored to Wellington’s unique needs. The agency’s expertise in local risks, like hurricanes, ensures we get the best homeowners insurance Wellington FL can provide. We can connect through their website or call for direct assistance. Expect a friendly chat with knowledgeable agents ready to answer any questions. Whether we’re curious about coverage options or specific discounts, Ackerman is there to guide us. This local touch alleviates concerns, making our insurance journey smooth and reassuring. Their commitment to top-notch service sets them apart in the community.

Conclusion

Choosing the right homeowners insurance is critical for protecting our investment. With the myriad of options available in Wellington, FL, it can feel like we’re navigating a maze. That’s where Ackerman Insurance Agency steps in as a guiding light. They provide local expertise and customized solutions that cater to our unique needs.

We’ve explored the significance of flood insurance and how it becomes a lifeline in Florida’s unpredictable climate. We’ve also learned how to potentially lower premiums through smart strategies. Engaging with a local agency like Ackerman not just makes the process smoother but also ensures we’re well-covered. By taking these steps, we safeguard our homes and enjoy peace of mind, knowing we’re prepared for whatever comes our way.

FAQ

- What makes Ackerman Insurance Agency a top choice in Wellington, FL?Ackerman Insurance Agency stands out for its personalized service and local expertise. We understand Wellington’s unique risks, like hurricanes and flooding. Our clients appreciate our tailored solutions and competitive pricing. Plus, we’re always ready to lend a helping hand.

- Is homeowners insurance mandatory in Florida?While Florida law doesn’t mandate homeowners insurance, lenders often require it for mortgages. It’s essential for protecting your home, belongings, and liability. Without it, you might face significant financial risk if disaster strikes.

- What factors influence homeowners insurance rates in Florida?Several elements affect rates, including your home’s age, construction type, and location. Homes in high-risk areas, like hurricane zones, might have higher premiums. Your claims history and credit score also play a role in determining rates.

- How can I lower my homeowners insurance premiums?Consider raising your deductible or installing safety features like alarm systems. Bundling multiple policies can lead to discounts. Regularly reviewing your policy ensures you’re not overpaying and still getting the best coverage.

- Is flood insurance necessary for Florida homeowners?Absolutely! Standard policies typically don’t cover flood damage. Given Florida’s flood-prone areas, it’s wise to purchase separate flood insurance. This ensures you’re fully protected against potential water-related damages.